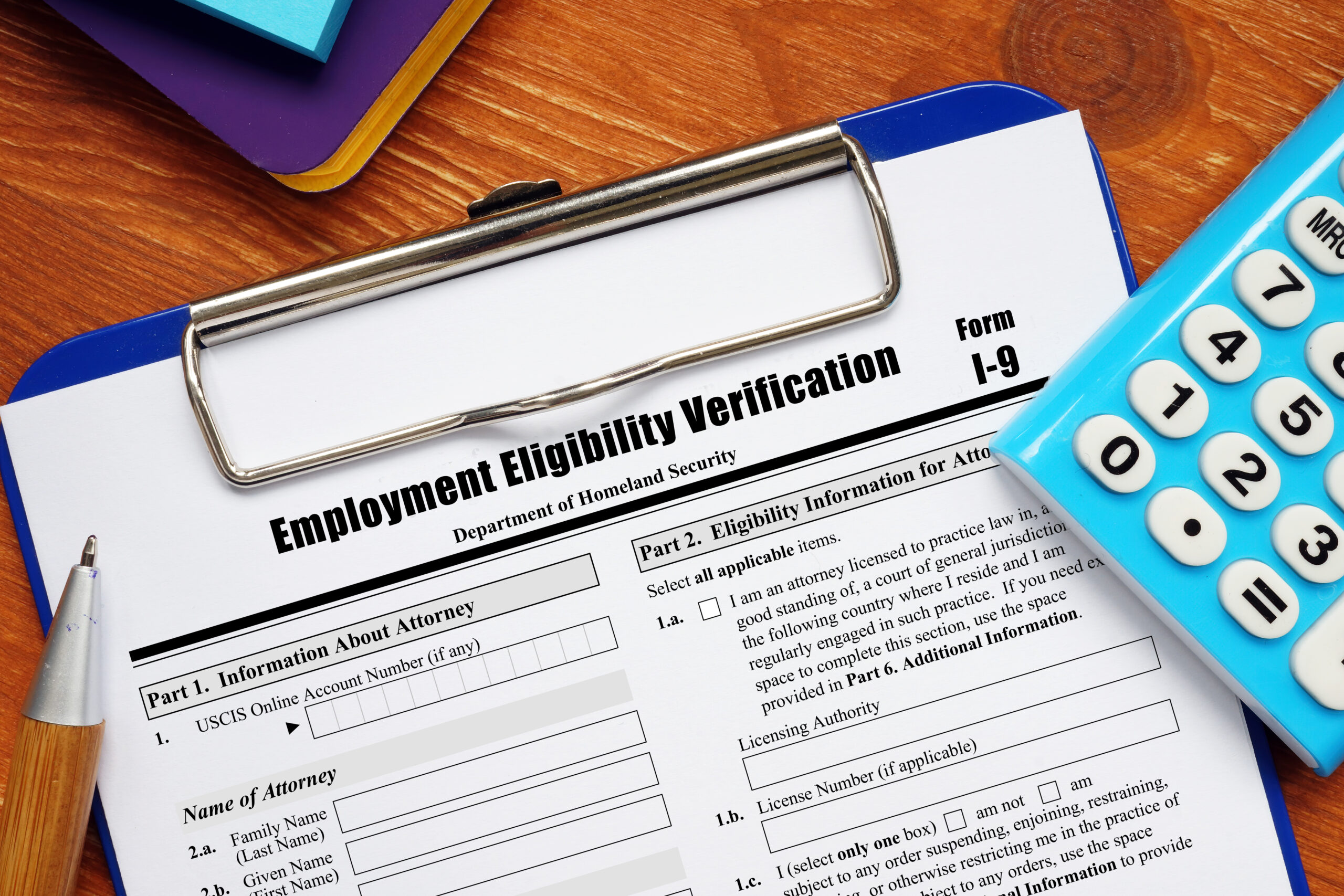

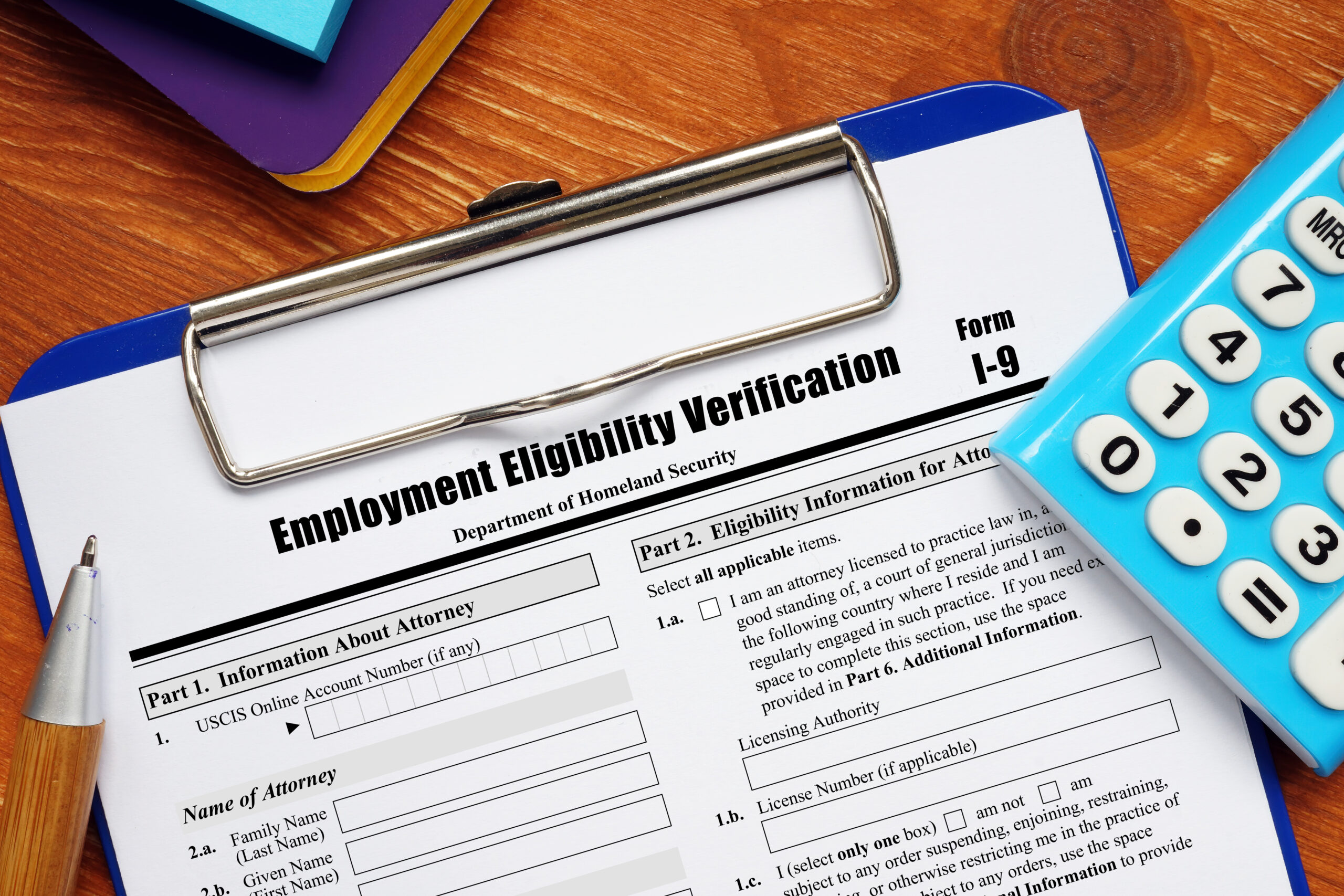

The I9 Form and Rules for Immigrants – Can You Remotely Verify or Not?

Exploring the I9 form process can be a tricky endeavor, especially when it comes to the rules for immigrants. As you deal with the complexities

Exploring the I9 form process can be a tricky endeavor, especially when it comes to the rules for immigrants. As you deal with the complexities

To grasp bonus taxation, remember: you carry the tax weight, and bonuses face federal tax, Medicare, and Social Security deductions. Employers handle tax withholding using

In the realm of international employment, the H-1B visa stands as a gateway for skilled workers to pursue career opportunities in the United States. However,

If navigating the world of HR outsourcing feels like exploring a maze with multiple paths, the distinction between a Professional Employer Organization (PEO) and Human

Are you aware of the significant impact that succession planning can have on the future of your organization? While it may not immediately come to

New York, NY

Manlius, NY

Southport, CT

Denver, CO

Fill out the form below and a member of our team will contact you within 10 minutes. (Mon-Fri 8am-6pm EST)